Lower Insulin Prices for Medicare Beneficiaries in 2021

This is a guest blog by Danielle K. Roberts, Medicare Expert

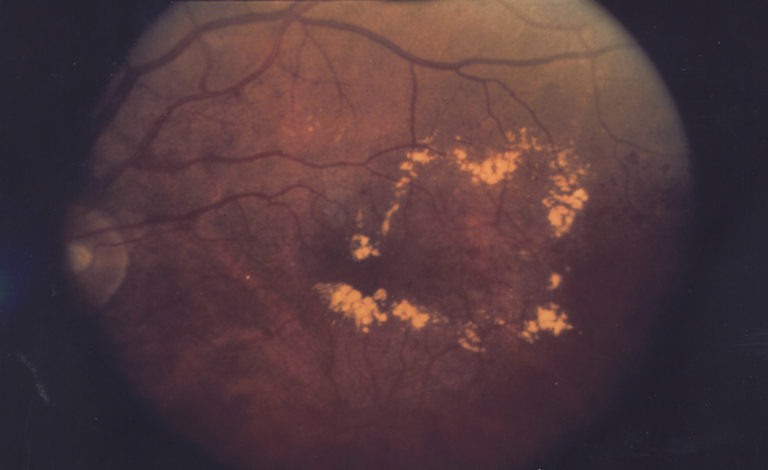

According to the American Diabetes Association (ADA), there are 7.4 million Americans that use at least one form of insulin to treat diabetes. Out of those 7.4 million, 3.3 million are Medicare beneficiaries. With diabetes being the seventh leading cause of death in America, the access to affordable insulin is still few and far between for many diabetic patients.

Insulin is an essential item to keep diabetics healthy and alive. The cost of insulin has more than doubled since the early 2000s for Medicare beneficiaries. With that said, this has led seniors to ration or not receive insulin at all. In 2020, one vial of insulin can cost upwards of $500 and some people need more than one vial a month. Many senior citizens live on a fixed income, making it more challenging to budget month-to-month solely for insulin.

The shocking increase of insulin prices has not gone unnoticed, and you will begin to see changes in 2021. The White House has announced that the Part D Senior Savings Model will be available for the upcoming Annual Election Period and will lower insulin prices for Medicare beneficiaries in 2021.

Part D Senior Savings Model

The Part D Senior Savings Model is predicted to save Medicare beneficiaries 66 percent in out-of-pocket spending for insulin. The substantial annual savings will be due to the maximum copay of $35 for a 30-day supply of insulin. This Model will be a new, voluntary option that Part D and Medicare Advantage plans can opt-in.

According to Centers for Medicare & Medicaid Services (CMS), over 1,750 Medicare Part D and Medicare Advantage plans have already requested to participate in the Model for the upcoming year. Predictable copays is the overall goal of the Model and are now encouraged by the CMS.

The Model is anticipated to be available in all 50 states, including Puerto Rico and the District of Columbia. President Trump has created a partnership with pharmaceutical manufacturers and will deliver these lowered insulin prices to America’s senior citizens.

Part D requirements

For a Part D sponsor or a health insurer to participate in the Model, there are specific requirements they must meet and uphold. All participants must cover both pen and vial dosage forms for the different types of insulin on the drug formulary. Drug manufacturers must also include all their insulin products to the Model participants with no exclusions.

The copay for a 30-day supply for insulin will cap at $35, and a Model participant cannot increase this number. However, Part D sponsors and health insurers are competitive. Therefore, it is likely that you will find a copay lower than $35 and may find higher quality of insulin with certain carriers for a lowered price. You will discover this when you begin researching the enhanced Part D plans.

Enrolling in an enhanced Part D plan

In September 2020, CMS will release the enhanced Part D premiums and copays for Medicare beneficiaries. Around this time, you will also be receiving your Annual Notice of Change. When you receive this letter, you will want to read through it thoroughly, so you can make an informed decision on if switching plans should be your next step.

The Annual Election Period will be the time for you to drop, change, or enroll in a Medicare Advantage or Part D plan. The AEP timeframe begins on October 15, 2020, and will end on December 7, 2020. Medicare.gov has a Medicare Plan Finder tool that is user-friendly. This tool will filter out the non-participating plans in the Model and display the premiums and copays for the enhanced Part D plans.

The Part D Senior Savings Model is long overdue but will create a positive impact on Medicare beneficiaries with diabetes. CMS Administrator, Seema Verma, has mentioned that if the Model is successful, they hope to expand the Model to counter other drugs.